You probably don't know it, but the answer to America's gasoline addiction could be under the hood of your car. More than five million Tauruses, Explorers, Stratuses, Suburbans, and other vehicles are already equipped with engines that can run on an energy source that costs less than gasoline, produces almost none of the emissions that cause global warming, and comes from the Midwest, not the Middle East.

These lucky drivers need never pay for gasoline again--if only they could find this elusive fuel, called ethanol. Chemically, ethanol is identical to the grain alcohol you may have spiked the punch with in college. It also went into gasohol, that 1970s concoction that brings back memories of Jimmy Carter in a cardigan and outrageous subsidies from Washington. But while the chemistry is the same, the economics, technology, and politics of ethanol are profoundly different.

Instead of coming exclusively from corn or sugar cane as it has up to now, thanks to biotech breakthroughs, the fuel can be made out of everything from prairie switchgrass and wood chips to corn husks and other agricultural waste. This biomass-derived fuel is known as cellulosic ethanol. Whatever the source, burning ethanol instead of gasoline reduces carbon emissions by more than 80% while eliminating entirely the release of acid-rain-causing sulfur dioxide. Even the cautious Department of Energy predicts that ethanol could put a 30% dent in America's gasoline consumption by 2030.

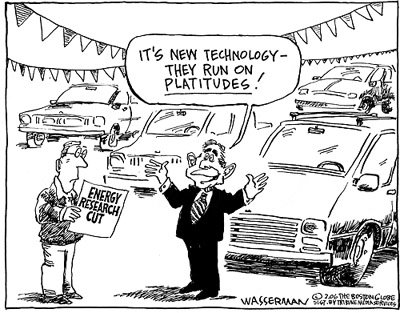

We may not have to wait that long. After decades of being merely an additive to gasoline, ethanol suddenly looks to be the stuff of a fuel revolution--and a pipe dream for futurists. An unlikely alliance of venture capitalists, Wall Streeters, automakers, environmentalists, farmers, and, yes, politicians is doing more than just talk about ethanol's potential. They're putting real money into biorefineries, car engines that switch effortlessly between gasoline and biofuels, and R&D to churn out ethanol more cheaply. (By the way, the reason motorists don't know about the five-million-plus ethanol-ready cars and trucks on the road is that until now Detroit never felt the need to tell them. Automakers quietly added the flex-fuel feature to get a break from fuel-economy standards.)

What's more, powerful political lobbies in Washington that never used to concern themselves with botanical affairs are suddenly focusing on ethanol. "Energy dependence is America's economic, environmental, and security Achilles' heel," says Nathanael Greene of the Natural Resources Defense Council, a mainstream environmental group. National- security hawks agree. Says former CIA chief James Woolsey: "We've got a coalition of tree huggers, do-gooders, sodbusters, hawks, and evangelicals." (Yes, he did say "evangelicals"--some have found common ground with greens in the notion of environmental stewardship.)

The next five years could see ethanol go from a mere sliver of the fuel pie to a major energy solution in a world where the cost of relying on a finite supply of oil is way too high. As that happens, says Vinod Khosla, a Silicon Valley venture capitalist who has become one of the nation's most influential ethanol advocates, "I'm absolutely convinced that without putting any more land under agriculture and without changing our food production, we can introduce enough ethanol in the U.S. to replace the majority of our petroleum use in cars and light trucks."

Filling up on ethanol isn't new. Henry Ford's Model Ts ran on it. What's changing is the cost of distilling ethanol and the advantages it brings over rival fuels. Energy visionaries like to dream about hydrogen as the ultimate replacement for fossil fuels, but switching to it would mean a trillion-dollar upheaval--for new production and distribution systems, new fuel stations, and new cars. Not so with ethanol--today's gas stations can handle the most common mixture of 85% ethanol and 15% gasoline, called E85, with minimal retrofitting. It takes about 30% more ethanol than gasoline to drive a mile, and the stuff is more corrosive, but building a car that's E85-ready adds only about $200 to the cost. Ethanol has already transformed one major economy: In Brazil nearly three-quarters of new cars can burn either ethanol or gasoline, whichever happens to be cheaper at the pump, and the nation has weaned itself off imported oil.

And have you heard about GM's yellow gas caps? In the next few weeks the auto giant is set to unveil an unlikely marketing campaign drawing attention to E85 and its E85-ready cars and trucks like the Chevy Avalanche. They will sport special yellow gas caps, and if you already own such a vehicle, GM will send you a gas cap free. California governor and Hummer owner Arnold Schwarzenegger is backing a ballot initiative that would encourage service stations to offer ethanol at the pump. Even big oil companies like Royal Dutch Shell and Exxon Mobil are funding ethanol research. Says Beth Lowry, GM's vice president for energy and environment: "People's perception used to be 'The agricultural lobby is very interested in it.' Now people are waking up and saying, 'This isn't just about the Midwest. This is about the U.S. as a whole.' " Adds Daniel Yergin, one of the country's top energy experts: "I don't think I've seen so many kinds of renewable energy fermenting and bubbling as right now. The very definition of oil is broadening."

Not that ethanol will replace gasoline overnight. There are 170,000 service stations in the U.S.; only 587 (count 'em!) sell E85. To refine enough ethanol to replace the gas we burn (140 billion gallons a year) would require thousands of biorefineries and hundreds of billions of dollars. Yet one of capitalism's favorite visionaries is convinced that very soon filling up on weeds and cornhusks will be no more remarkable than tanking up on regular. Says Richard Branson, whose Virgin Group is starting an ethanol-inspired subsidiary called Virgin Fuels: "This is the win-win fuel of the future."

BARRELS FROM BUSHELS

In Decatur, Ill., nobody is waiting around for the future; demand for ethanol from corn is booming right now. This grain-elevator-dotted town is home to agribusiness giant Archer Daniels Midland, which makes it the capital of the old-school heavily subsidized U.S. ethanol industry. On a blustery January day, the air is thick with fog, sleet, and condensation from the corn mills on the 600-acre complex next to ADM's corporate office. Outside the ethanol plant, the air smells like grape juice gone bad. Inside, with its giant vats and fermentation towers, the biorefinery resembles a winery, but it's much noisier.

ADM used to call itself "Supermarket to the World." Today, reflecting its emergence as an alternative-energy supplier, it boasts of being "Resourceful by Nature." The company created the corn-ethanol industry when Jimmy Carter asked it to in 1978--the oil-shocked President wanted a homegrown alternative to gasoline. ADM now pumps out more than a billion gallons of ethanol per year. While the fuel accounts for just 5% of the company's $36 billion in annual sales, analysts estimate that it generates 23% of ADM's operating profit. Says Allen Andreas, the courtly 62-year-old CEO: "We've always been feeding people and looking for better alternatives; now we're doing the same thing in energy."

ADM aims to be a big player in what Andreas calls the shift "from hydrocarbons to carbohydrates." But for now it's ignoring E85 and cellulosic ethanol in favor of keeping pace with demand that is already booming. Corn ethanol's main use is as an additive that helps gasoline burn more efficiently. ADM sells nearly its entire output to oil companies, which use ethanol as a substitute for MTBE, a petroleum-based additive that is toxic and is now banned in California and 24 other states. With two billion gallons of MTBE still in use annually and 25 states that have yet to ban it, the ethanol industry could grow 50% simply by replacing MTBE.

In September, ADM announced a nearly 50% expansion project, or 500 million new gallons of annual production capacity. Archrival Cargill is belatedly ramping up ethanol production, and new entrants are using private capital to build ethanol plants. The only publicly traded pure-play ethanol maker, Pacific Ethanol of Fresno, plans to build five plants in California and has raised a total of $111 million, including $84 million from Bill Gates. (For a guide to playing the ethanol boom, see Investing.) All told, the planned projects represent a nearly $2.6 billion investment and will increase U.S. ethanol capacity by 40%.

Other major players are making long-term ethanol bets. Ford is working with VeraSun, a startup in South Dakota, to promote E85 fueling stations. Shell is the primary backer of Canada's Iogen, which is attempting the first large-scale production of cellulosic ethanol--the kind made from cornstalks and grasses--at a pilot plant in Ottawa (see following story, "Biorefinery Breakthrough"). Exxon Mobil has pledged $100 million to Stanford University for research into alternative fuels. The oil giant's new CEO, Rex Tillerson, visited the campus last year to hear what researchers are cooking up. Biology professor Chris Sommerville says the change in the industry is palpable: "I went to six scientific conferences on biofuels last year; the previous 29 years I didn't go to any."

The biggest alternative-fuels player of all, of course, is Uncle Sam. Oil refiners receive a 51-cent tax credit for every gallon of ethanol they blend into their gasoline. That alone will cost taxpayers more than $7 billion over five years, estimates the Congressional Budget Office. The U.S. has also funded research into biodiesel, which uses deep-fryer grease and other nontoxic ingredients to replace regular diesel fuel. (See box at left.) But ethanol will never really take off unless consumers demand it, and while the U.S. industry still relies on taxpayer largesse, Brazil has leaped to the next step: a profitable free-market system in which the government has gotten out of the way.

HOW BRAZIL BEATS THE U.S.

Near the prosperous farm town of Sertãozinho, some 200 miles north of São Paulo, the fuel that will fill the tanks of nearly three million Brazilian cars in a few months is still waist-high. Lush sugar-cane fields stretch as far as the eye can see, interrupted only by the towering white mills where the stalks of the plants will be turned into ethanol when the harvest begins in March.

Brazil boasts the biggest economy south of Mexico, and with annual GDP growth of 2.6%, it is a powerhouse you might expect to consume growing amounts of oil, coal, and nuclear energy. But Brazil also happens to have the perfect geography for growing sugar cane, the most energy-rich ethanol feedstock known to science. And so, for Brazil's 16.5 million drivers, there is ready access to what's known in Portuguese as álcool at nearly all of the country's 34,000 gas stations. "Everyone talks about alternative fuels, but we're doing it," says Barry Engle, president of Ford Brazil. Ethanol accounts for more than 40% of the fuel Brazilians use in their cars.

While oil frequently has to be shipped halfway around the world before it's refined into gasoline, here the sugar cane grows right up to the gates of Sertãozinho's Santa Elisa mill, where it will be made into ethanol. There's very little waste--leftovers are burned to produce electricity for Santa Elisa and the local electrical grid. "The maximum distance from farm to mill is about 25 miles," says Fernando Ribeiro, secretary general of Unica, the trade association that represents Brazilian sugar-cane growers. "It's very, very efficient in terms of energy use."

Although Brazilians have driven some cars that run exclusively on ethanol since 1979, the introduction three years ago of new engines that let drivers switch between ethanol and gasoline has transformed what was once an economic niche into the planet's leading example of renewable fuels. Ford exhibited the first prototype of what came to be known as a flex-fuel engine in 2002; soon VW marketed a flex-fuel car. Ford's Engle says flex-fuel technology helps avoid problems that had plagued ethanol cars, such as balky starts on cold mornings, weak pickup, and corrosion.

Consumers loved flex-fuel because it meant not having to choose between ethanol and gas models--memories were still fresh of the 1990 sugar-cane shortage, when ethanol-car owners found themselves, well, out of gas. Today "nobody would buy an alcohol-only car, even with tax incentives," says sales manager Rogerio Beraldo of Green Automoveis, a sprawling dealership in São Paulo. "Brazilians are traumatized by our earlier experience, when supplies ran out. But with flex-fuel, there's no risk of that."

With Brazilian ethanol selling for 45% less per liter than gasoline in 2003 and 2004, flex-fuel cars caught on like iPods. In 2003, flex-fuel had 6% of the market for Brazilian-made cars, and automakers were expecting the technology's share to zoom to 30% in 2005. That proved wildly conservative: As of last December, 73% of cars sold in Brazil came with flex-fuel engines. There are now 1.3 million flex-fuel cars on the road. "I have never seen an automotive technology with that fast an adoption rate," says Engle.

Ethanol's rise has had far-reaching effects on the economy. Not only does Brazil no longer have to import oil but an estimated $69 billion that would have gone to the Middle East or elsewhere has stayed in the country and is revitalizing once-depressed rural areas. More than 250 mills have sprouted in southeastern Brazil, and another 50 are under construction, at a cost of about $100 million each. Driving to lunch at his local churrasco barbecue spot in Sertãozinho, the head of the local sugar-cane growers' association points to one new business after another, from farm-equipment sellers to builders of boilers and other gear for the nearby mills. "My family has been in this business for 30 years, and this is the best it's been," says Manoel Carlos Ortolan. "There's even nouveaux riches."

The key to Brazil's success is that consumers are choosing ethanol rather than being forced to buy it. Brazil's military dictators tried the latter approach in the 1970s and early 1980s, by offering tax breaks to build mills, ordering state-owned oil company Petrobras to sell ethanol at gas stations, and regulating prices at the pump. This bullying--and cheap oil in the 1990s--nearly killed the market for ethanol until flex-fuel came along. The regime wasn't good for much, says consultant Plinio Nastari, but it did create the distribution system that enables drivers to fill up on ethanol just about anywhere.

Even though the U.S. will never be a sugar-cane powerhouse like Brazil, investors now view Rio as the future of fuel. "I hate to see the U.S. ten years behind Brazil, but that's probably about where we are," says one shrewd American freethinker, Ted Turner.

ETHANOL FINDS A GODFATHER

There are venture capitalists, and then there's Vinod Khosla. A co-founder of Sun Microsystems and a partner at Kleiner Perkins, he was an early backer of Juniper Networks, whose technology helped end decades of dominance by traditional telecom manufacturers. A lean, 50-year-old native of India, Khosla says, without a hint of modesty, "I love the challenge of breaking monopolies."

Frustrated that Kleiner Perkins wasn't taking enough risks after the dot-com crash, Khosla opted out of Kleiner's most recent fund and started his own group, Khosla Ventures. He'd been dabbling in environmentalism but never expected to become an investor. Brazil's success, however, made him wonder about ethanol's U.S. potential. "I spent two years trying to convince myself that this was never going to be more than another minor alternative fuel," he says. "What I discovered was that ethanol might completely replace petroleum in this country. And a lot of countries. This was a great shock to me."

Pretty soon Khosla was surprising plenty of others. He put together a PowerPoint presentation, "Biofuels: Think Outside the Barrel," which he fires up on a moment's notice. He has made the pitch on ethanol to the President's Council of Advisors on Science and Technology and elsewhere in the White House. He is also behind California's upcoming ballot initiative to fund a subsidy for gasoline retailers that add E85 fuel pumps. "Getting distribution going is the real problem," says Khosla. "We need to increase blending and then introduce E85 pumps, and the possible will become the probable."

His conversion to energy investing is part of a Silicon Valley trend, as VCs seek the rapid growth and giant markets that computers once offered. VantagePoint Venture Partners in San Bruno, for instance, established a fund called New Energy Capital that invests in ethanol, wind power, and other energy projects. Nth Power, a San Francisco energy-investment firm, estimates that $700 million of the $21 billion flowing into venture funds last year were earmarked for "clean technology" startups.

CELLULOSE NIRVANA

No one, not even a professionally optimistic VC, thinks we're anywhere near getting rid of gasoline. The oil superstructure is simply too efficient and too entrenched to just go away. Nor could corn ethanol generate enough fuel to run America's cars, pickups, and SUVs. Already ethanol gobbles up 14% of the country's corn production. Converting a bigger share into fuel would pinch the world's food supply--a favorite objection of skeptics. Critics also contend that producing fuel from crops consumes more energy than it yields. On this topic of endless Internet bickering, the Energy Department recently reported, "In terms of key energy and environmental benefits, cornstarch ethanol comes out clearly ahead of petroleum-based fuels, and tomorrow's cellulosic-based ethanol would do even better."

Because cellulosic ethanol comes from cornstalks, grasses, tree bark--fibrous stuff that humans can't digest--it doesn't threaten the food supply at all. Cellulose is the carbohydrate that makes up the walls of plant cells. Researchers have figured out how to unlock the energy in such biomass by devising enzymes that convert cellulose into simpler sugars. Cellulose is abundant; ethanol from it is clean and can power an engine as effectively as gasoline. Plus, you don't have to reinvent cars. Ratcheting up production of cellulosic ethanol, however, is a gnarly engineering problem.

The onus now is on companies like Genencor, a Palo Alto biotech. Its biological enzymes are used to break down stains in Tide detergent and achieve just the right distressed look in blue jeans. But making underpants whiter and denim bluer is nothing compared with breaking America's longstanding addiction to gasoline. The best way to do this would be to bring down the cost of ethanol to the point where consumers clamor for it. Before flex-fuel engines came along, Brazilians would mix their own rabo de galo (cocktail) of ethanol and gasoline when filling up, simply because it was cheaper than straight gas. Genencor says its enzymes have cut the cost of making a gallon of cellulosic ethanol from $5 five years ago to 20 cents today. Now refiners have to learn how to scale up production. Canada's Iogen is the furthest along in commercialization; another hopeful is BC International, a Dedham, Mass., company that's building a cellulosic ethanol plant in Louisiana.

There's still a role for government--and we don't mean more handouts for corn growers or distillers. The recently enacted energy bill takes steps in the right direction, like mandating the use of 250 million gallons of cellulosic ethanol a year by 2013, but much more can be done. Easing the tariff of 54 cents per gallon on imports of ethanol from Brazil and other countries would certainly help. Because sugar cane generates far more ethanol per acre than corn, Brazil can produce ethanol more cheaply than the U.S. Not only would importing more of it broaden access to ethanol for U.S. buyers, but it would also make it cheaper for the ultimate consumers--us. That in turn would spur demand at the pump and encourage service station owners to offer ethanol more widely. What's also needed is for someone big--like Shell or BP, which tout themselves as green companies--to commit to cellulosic ethanol on a commercial scale. Shell's bet on Iogen is minuscule compared with the $20 billion it plans to spend on producing oil and gas off Russia's Sakhalin Island.

Of course, the timing of when ethanol goes from dream to reality isn't just a matter of an investment here or a subsidy there. It took decades of ferment in Brazil before serendipity in the form of high gas prices and flex-fuel engines made ethanol an everyday choice for consumers. But the sooner we start, the greater our ability to shape a future that's not centered on increasingly expensive oil and gas. It's not as if gasoline demand is going to go down: As long as the Chinese and the Indians want our lifestyle--and they do--you can forget about oil at $10 or even $20 a barrel. Whatever the technological challenges, a world of abundant, clean ethanol is suddenly looking a lot more realistic than a return to the days of cheap, inexhaustible oil.

FORTUNE Magazine